Theodore Roosevelt once said, “Nothing worth having comes easy.” That certainly rings true for owning a home. However, certain aspects of VA loans such as interest rates, loan-to-value and DTI guidelines may make VA loans more enticing to some borrowers.

Mortgage qualifying is a delicate balance of an applicant’s credit, income and assets. So when it comes to getting approved, VA-eligible borrowers may currently have a slight edge. New data from the Origination Insight Report from Ellie Mae compares closed VA and conventional loans. The report shows VA borrowers being approved with lower average credit scores, higher DTI ratios, and lower rates, and VA loans have a higher closing rate.

Less-than-perfect FICO Scores are Okay for VA Loans

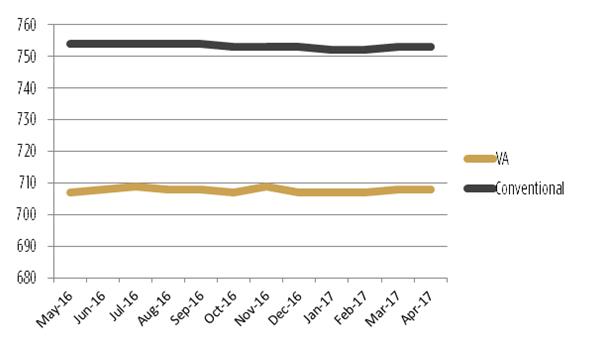

The VA does not publish a minimum credit score in its guidelines. The lender is responsible for vetting a borrower’s credit, income and debt to VA standards. Lenders typically establish additional credit guidelines, such as minimum score. Lenders vary, but a score of 620 or above is typically acceptable for VA loan approval. According to the Ellie Mae data, VA borrowers had average scores below 710, while conventional hovered above 750 between May 2016 and April 2017.

This graph compares average FICO scores for closed VA and conventional borrowers. The spread is consistently about 50 points.

VA and Conventional Borrowers’ FICO Score Comparison

Do you know your FICO score? It’s easy to find out. Just get in touch with an approved lender by clicking here.

VA Borrowers can be Approved with Maximum Debt

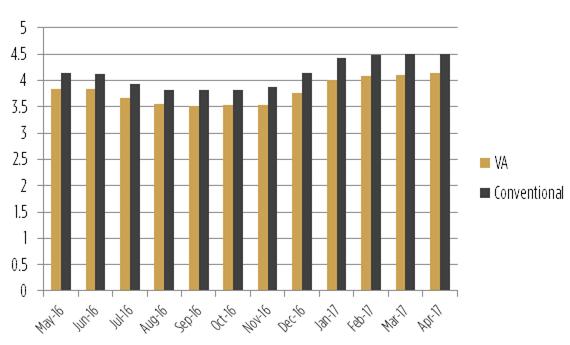

In addition to your credit score, lenders are going to look closely at your debt-to-income or DTI ratio. DTI is a personal finance measure that compares monthly debt payments to the income you bring in. Front- and back-end DTI ratios for conventional loans were 23% and 35%, while VA numbers were 23% and 41% in March of 2017.

VA and Conventional DTI Comparison

VA borrowers are being approved with slightly more debt, but still within qualifying standards. That’s not to say that the Veterans’ loan program allows for more debt. Conventional loans follow qualified mortgage (QM) standards, which require a DTI of 43% or less. VA wants a DTI of 41% or less. It is worth noting that the VA standard for DTI is slightly more rigorous than QM. That said, the VA rule is not cut in stone. Borrowers have been known to be approved with a DTI higher than 41% if they can compensate with more residual income or certain other factors.

NEXT STEP: Find out where you stand with DTI. Start talking to an approved lender by clicking here.

VA Interest Rates Show No Penalty for Lower Qualifying Numbers

While VA borrowers are closing with less-than-perfect credit averages, they don’t seem to be punished with higher interest rates. In fact, the opposite appears to be true. Interest rates for the government-backed home loans in the Ellie Mae sample are consistently lower than conventional. Just look at this chart comparing interest rates for VA and conventional loans for one year. The spread ranges between .27 and .41 percent. Just that small fraction of a point can save eligible borrowers up to $75 per month on an average loan of $260,000.

VA and Conventional Mortgage Interest Rates Comparison

Fewer Liquid Assets Needed for a VA Mortgage

When you consider the costs required to get into a home, it’s nice to know that one loan program generally requires less cash out-of-pocket than the rest. The Department of Veterans Affairs will back about 25% of a VA mortgage for the lender up to conforming loan limits. In most cases, the backing secures enough of the loan so that the lender doesn’t need a down payment. Three scenarios for down payment VA loans exist:

- Home is priced over the loan limit

- Borrower’s entitlement is less than 25% of the loan

- Borrower opts for a down payment

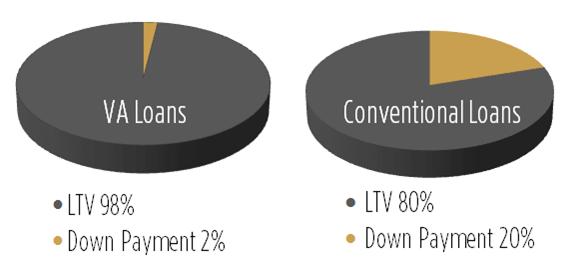

The average down payment for closed VA loans is just 2%. The conventional average in the Ellie Mae data is 20%. Cash put toward a down payment ultimately reduces the loan principal. A comparison of the principal to the home’s value is known as loan-to-value or LTV. While VA loans allow for 100% LTV, the conventional max is 97%.

Look at the charts and see the difference between VA and conventional LTVs:

VA and Conventional LTV and Down Payment Comparison

Closing Rates Better for VA Home Loans

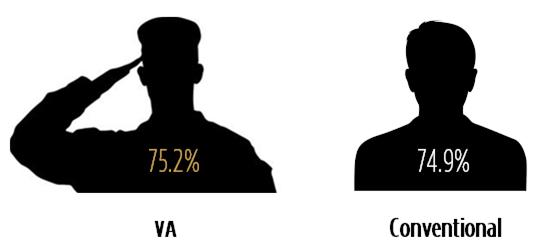

Could it be true that eligible borrowers are more likely to be approved for VA home loans? When you consider closing rates for VA and conventional loans, the numbers don’t lie. Take a look at the percentage of loans closed for each program in the 90 day cycle ending with March, 31 2017. VA loans have a slightly better closing rate.

Mortgage Closing Rate Comparison

The VA has stated that Veterans have more access to home ownership through the VA Home Loan Guaranty Program, and the most recent data seems to confirm it.

Ready to Get Started?

If you're ready to get started, or just want to get more information on the process, the first step is to get multiple rate quotes with no obligation. You can then discuss qualifications, debt to income ratios, and any other concerns you have about the process with the lenders.